Building appetite in the supply chain for HS2 through Early Market Engagement

In 2013 HS2 Ltd, as the client organisation and delivery body for HS2, was a new client, with no mandate (Act of Parliament) and no captive supply chain. It was highly politically sensitive, competing with established portfolio clients (National Highways, Network Rail, Transport for London etc), in a sector experiencing high demand during a time of economic growth.

The aim was to become the client of choice to the rail and construction industry, encourage the supply chain to integrate HS2 demand into future business plans and secure business stakeholder advocacy for the project. The successful delivery of extensive early market engagement during 2013-2020, for the procurement of contracts valued at billions of pounds, resulted in enhanced competitive tension during the tendering process. Over the procurement programme, minimal surprises were experienced, thanks to strong procurement and contract information flow and communication between client and prospective suppliers, which enabled an informed client and supply chain.

Key learnings were the criticality of building supply chain appetite and capacity to meet mega-project demand, the importance of procurement strategies to maximize market forming and influence the future business plans of target suppliers, and the role of early engagement to help potential suppliers prepare their approaches in alignment with the value requirements of the project, such as benefits, skills, sustainability, and local legacy.

This paper should be of benefit to future project procurement and supply chain professionals working in UK infrastructure. It is designed to ensure that future projects can maximise the benefits of early market engagement through a considered and thorough approach.

Background and industry context

HS2 is the largest infrastructure project the UK has undertaken for decades. Between London and the West Midlands, the construction of the railway comprises 64 miles of tunnel, 500 bridges, 70 cuttings and 50 viaducts, alongside four huge new stations.

In 2013, when the Supply Chain Management team was established, HS2 Ltd had not yet received parliamentary approval to proceed. This meant it had no mandate to acquire land, no budget to begin construction and no Act of Parliament that gave it the powers required to begin work. However, as a project of enormous scale it was evident that an unprecedented amount of resource would need to be mobilised to deliver this ambitious mega-project. Learnings were adopted from both London 2012 (Olympics) and Crossrail Ltd (now the Elizabeth Line) – two programmes which formalised early market engagement practices prior to them being considered industry best practice. For example, during early market engagement, it was discovered that there was highly limited market appetite to bid for the contract to deliver the Olympic Stadium, due to the poor track record of previous stadium builds (e.g. Wembley) and high perceived risks. This reiterated the importance of not taking supplier appetite for granted on high-profile projects. This knowledge transfer was achieved through recruitment of personnel who had previously worked on these programmes, alongside review of the various learning legacy material.

To deliver the railway, HS2 Ltd had to ensure there would be enough market capacity with the right capability to meet the unprecedented impending demand that would emerge once parliamentary approval was given. The political appetite to ensure ‘spades in the ground’ from the outset, alongside a challenging schedule, meant early market engagement and procurement would need to be conducted three to four years in advance of the Act receiving Royal Assent in 2017. As a new organisation with no track record as a client and no existing supply chain, HS2 Ltd recognised the need to engage the global supply market at an earlier stage and more fully than ever before on a major infrastructure project.

Central to the approach was a recognition that the scale of HS2 provided a significant opportunity for successful bidders to make a long-term investment in their capability and skills base, creating jobs and driving growth. HS2 Ltd needed to assemble a project supply chain on a scale never seen before in UK history, and one which was engaged, informed, capable and committed.

The demand market was dominated by large portfolio infrastructure clients who had well established supply chains with a strong historic and future pipeline of demand – including the two other Arms-Length-Bodies (ALBs) to the Department for Transport (DfT), Network Rail and National Highways – alongside other key infrastructure clients across energy, utilities, defence and transport.

The nature of the supply market was always likely to create challenges. The UK construction industry is highly fragmented with a heavy dependence on extensive subcontracting through many layers of the supply chain. It has traditionally struggled for profitability and productivity, which hampers investment in new technology, and lacks the much larger, more integrated contractors seen in continental Europe. [1] [2] Embarking on a project the scale of HS2 would therefore necessitate a high volume of subcontracting, a supply chain of thousands of suppliers down many tiers, alongside a degree of imported capability and the building up of a fragile UK-supply and skills base.

Therefore, understanding and building the appetite of the supply chain to develop and construct HS2 was imperative to answering the question of whether there was enough capacity in the market. With this in mind, HS2 Ltd formed a Supply Chain Management function charged with the task of informing the market of the impending demand and building appetite throughout the supply chain to meet that demand, competing for finite supply in a constrained market alongside existing well-established clients.

Approach

Over a period of five years, HS2 Ltd went from a client with no supply chain to one that in 2018 was mobilising a workforce of over 10,000 across 1,000 suppliers and 250 work sites. HS2 Ltd was essentially a start-up organisation which had to grow and develop its capability at rapid speed to become a FTSE 250 equivalent (in terms of cash-flow) and portray this capability to the market to build confidence in the project and opportunity. Through a clear, consistent and well-communicated vision, mission and strategic goals, HS2 Ltd managed to attract a commitment of supply chain appetite from a large part of the construction sector.

At ‘tier 1’ level, i.e. suppliers contracting directly with HS2 Ltd, the supply market formed specific joint ventures, often a collaboration between UK contractors with local market experience and European contractors with high-speed rail experience. HS2 actively drove this ‘market forming’ by providing early visibility of pre-qualification requirements and the levels of past high speed rail capability that needed to be demonstrated, with a similar approach adopted across other procurement categories.

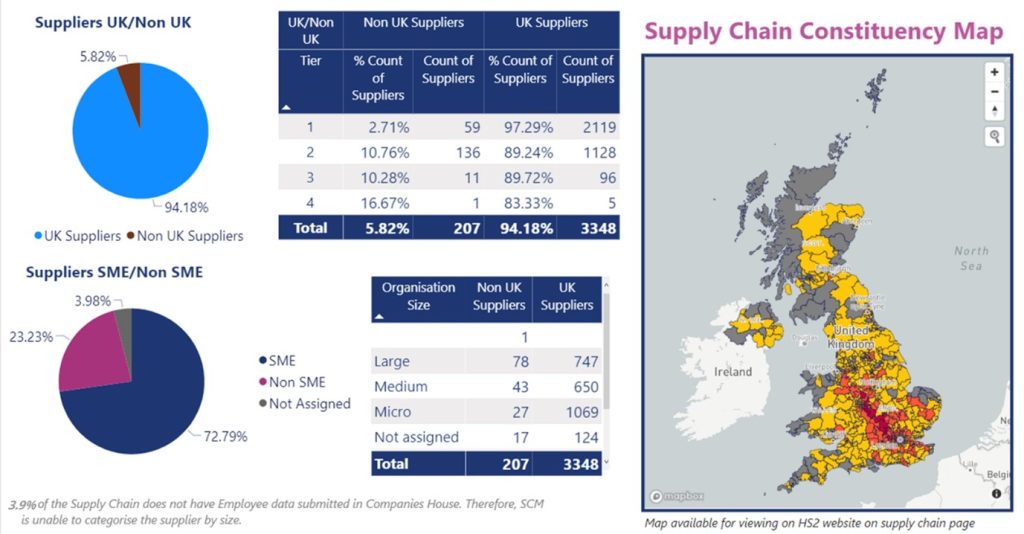

Suppliers typically in the lower tiers of long construction supply chains, many of whom were micro and small, medium-sized enterprises (SMEs), across all corners of the UK, were directly engaged by the HS2 SCM team to inform them of how they too could get involved with delivering the project. This was driven in part by the expected high reliance upon SME capability, and the economic benefits of ensuring the investment in HS2 was flowed down into businesses the length and breadth of the UK, creating jobs, skills and growth. As such, and based upon data of previous construction projects, a benchmark was set to award 95% of all contracts to UK-based suppliers and 60% to SMEs.

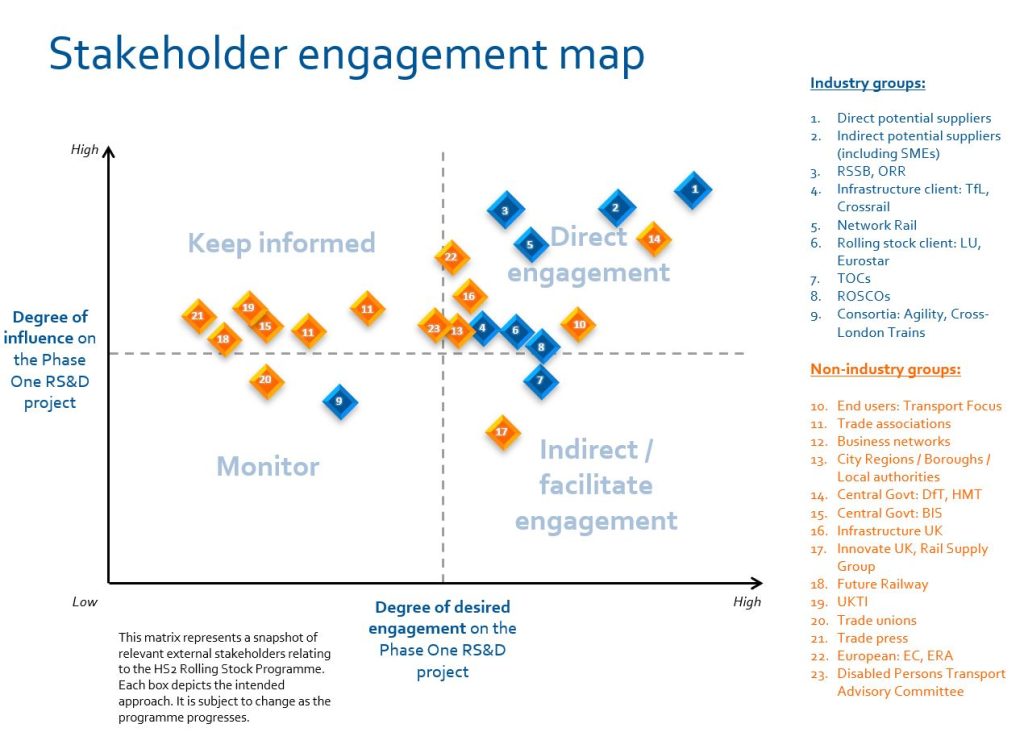

The starting point of this engagement activity was an exercise to map all stakeholders, both internally and externally to HS2 Ltd (see Figure 2 – Rolling Stock Case Study as an example), including government, trade bodies, business networks as well as suppliers. It was vital to keep these groups abreast of developments to build confidence and credibility in HS2 Ltd as a client, and inform and refine developing procurement strategies, specifically around packaging (the dividing up of scope into specific contracts), perceived risks and commercial approaches. Parallel to this, the HS2 SCM team completed a desktop exercise to understand the worldwide capability of the high-speed rail construction supply chain, identifying specific areas of expertise and a network of relationships between contractors that had previously formed.

In 2013, HS2 Ltd held the first national conference to launch the project in Birmingham [3]. At this, the Secretary of State for Transport, HS2 Chair and Commercial Director set out the following:

- The scale of the opportunity.

- A high-level programme (schedule).

- Specific value requirements through a balanced scorecard for procurement.

- The outline packaging strategy (how contracts would be split up).

- The outline contracting strategy (the commercial terms).

- An overview of our approach to market engagement.

- The type of client HS2 Ltd wanted to be; and

- The next steps for both HS2 and the supply chain.

A commitment was given to progress next steps as follows:

- The Phase One (London-Birmingham) category procurement strategy would be further evolved from draft towards finalisation. In the process stakeholders would be consulted with feedback gained from key organisations via appropriate networks, including:

- Umbrella Bodies & industry Trade Associations.

- Regional Chambers of Commerce, Growth Hubs and Local Enterprise Partnerships.

- National engagement via Enterprise Agencies in Scotland, Wales and Northern Ireland.

- Intensive strategic communications would continue, including political stakeholders, through a range of roadshows, forums, newsletters and engagements.

- Outputs would be shared at future supply chain conferences and market engagements.

The 2013 conference was followed by a series of workshops with UK trade associations such as the Civil Engineering Contractors Association (CECA), where the HS2 SCM team sought to gain input in relation to the size, scope and routes to contract, which informed the basis for the draft procurement approaches. Now with the outline of engagement disseminated and stakeholders mapped, the SCM team developed an engagement plan – this was launched with the second national HS2 supply chain conference, held in Manchester and London in 2014.

It was at this conference that HS2 Ltd encouraged the formation of Joint Ventures within the Tier 1 contractor community and informed the supply chain that while HS2 Ltd would be procuring relatively few, large contracts directly it would be putting in place mechanisms to give free access to the thousands of lower tier supply chain opportunities that would flow from these, in order to maximise UK and SME content.

The key messages and outputs delivered at the 2014 conference[4] were as follows:

- High level view of the direct HS2 opportunities pipeline (tender event schedule) to build confidence and certainty in the market.

- Launch of the tier 1 market engagement exercises in response to specific procurements, e.g. design consultancy and enabling works. Activities included market sounding exercises, 1-to-1 meetings, workshops, etc.

- The aim to deliver specific project and/or category industry days, inviting the whole potential supply chain.

- Communication of the strategy for common components and commodities across the construction programme.

- Launch of the regional engagement roadshows where HS2 Ltd would target local and smaller suppliers to explain how to get ready for HS2 supply chain opportunities and the steps to take to ready their business to bid.

- Publication of a HS2 Supplier Guide, FAQs and series of online material [5], aimed at all tiers of the supply chain.

- A plan to run industry days or ‘meet the contractor’ events. HS2 SCM would work with appointed tier 1 suppliers to carefully understand their procurement pipeline and match it with suppliers across the UK, via established trade networks to maintain impartiality, to broker connections and maximise SME involvement on a massive scale.

Following the broad-narrative events described above, typically undertaken to ‘launch’ the scale of the opportunity and generate interest, the next step of engagement was to undertake more detailed, focused activity with representations of the market for different categories. The SCM team made extensive use of third-party trade associations and business networks, such as the Association for Consultancy & Engineering, the Civil Engineering Contractors Association, Build UK, the Railway Industry Association and others to help identify a relevant pool of potential suppliers which HS2 Ltd could invite to participate in a category or contract-specific market engagement.

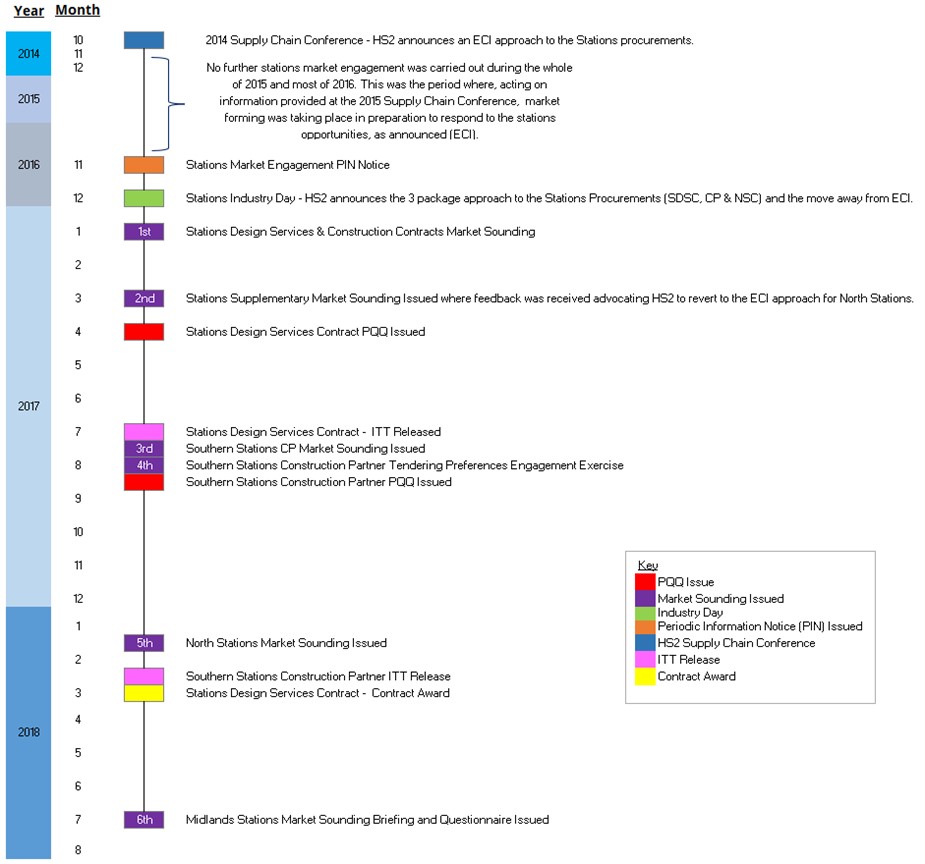

The individual category engagement plans were developed and implemented, for enabling works, civil engineering, professional services, stations and railway systems. An example of the timeline for market engagement under the stations category is contained under Figure 1. A market engagement ‘options menu’ (see Supporting Materials) was developed which set out the different approaches the SCM team would undertake, on behalf of the procurement lead for a particular contract package, to maximise the value of the engagement. Engagements were tailored to the nature of the procurement and market, working backwards from the intended procurement launch date.

Market sounding briefings and questionnaires were developed which set out the high-level scope of the requirement, the intended procurement route, form of contract, timescales for procurement and delivery and any other key features of the procurement. This would then be issued to targeted suppliers to ‘test’ the approach, seek feedback and use this to inform the development and finalisation of the procurement strategy. Questionnaires were developed to elicit feedback which could be quantified to understand areas of consensus or divergence (e.g. through use of yes/no questions and tick boxes), with free text fields provided for suppliers to provide further context to their response or express any caveats or concerns. Ensuring questions were clearly and appropriately worded so as not to stray into procurement questions but to ensure an accurate view of market consensus was important for report writing to capture findings. This ensured recommendations were backed by data and evidence which in turn supported internal and external governance and assurance processes.

Further engagement frequently took place with those who registered appetite for the opportunity, in the form of structured 1:1 supplier meetings. This enabled HS2 stakeholders to further explore supplier responses and for suppliers to pose questions and clarify or expand upon their views. Internal staff and supplier briefings were provided in advance to set out the rules of the engagement, key agenda items etc. and detailed minutes were undertaken to ensure good record-keeping. As always when conducting market engagement, it was imperative to ensure equal treatment across potential suppliers, share information freely and transparently and ensure decisions did not discriminate or unfairly advantage one supplier over another.

A key learning was the need to establish a clear client position with regard potential, perceived or actual conflicts of interest and how suppliers could or could not interact with different contract opportunities (e.g. client side vs. supply side opportunities, especially in relation to engineering consultancies). This had to be balanced with the need to preserve a degree of flexibility, in the face of evolving project requirements and procurement pipelines and ensure access to the best market talent, without compromising the probity of the process.

Through a combination of regional roadshows, third party events, media activity and workshops, HS2 Ltd’s SCM team undertook a wide ranging and intensive period of wider business engagement to drum up interest in HS2 opportunities across the UK. This extended far beyond the contracts that HS2 Ltd was buying directly, to include the many thousands of opportunities that would manifest through the tiers of the supply chain.

Figure 2: Stakeholder engagement map for rolling stock

HS2 Ltd needed to buy a fleet of over 50 trains capable of 360kmh (225mph) operation to meet the Sponsor’s journey time requirements of the railway and the restrictive UK loading gauge, in order to link towns and cities beyond the high-speed line. Industry-leading requirements on capacity, noise reduction, energy efficiency and reliability also necessitated a period of market engagement to “sell” the opportunity, build an appropriate commercial model, refine the technical requirements and influence suppliers’ product development curves to shape the market to HS2.

The team began this in 2014, three years before the procurement start date, to develop the approach in collaboration with industry, whilst maintaining the highest standards of integrity, ethical behaviours and equal treatment of all potential suppliers globally. The initial exercise was to map all stakeholders relating to the project to determine an appropriate engagement plan:

Example stakeholder engagement map for rolling stock

Turning attention to the supply market, research suggested the majority of the world’s proven operational high-speed trains derived from only a handful of product platforms and suppliers. So the team had to build interest in a complex, concentrated market, to secure production capacity in what could be perceived as a high-risk project. There was an opportunity for ‘blank canvas’ thinking, incorporating the best in global rail technology and whole-system design (given it is rare for the railway infrastructure and train fleet to be designed in tandem), based around an exemplary passenger service. An initial potential supply base of 14 global suppliers was identified which reduced to seven early expressions of interest. Following 35 1:1 meetings, seven further market soundings, supply chain surgeries, workshops and six international site visits, alongside extensive engagement with government, the team delivered a market-leading engagement programme. This helped to fundamentally de-risk the procurement and deliver enhanced competition with strong appetite throughout every stage of the procurement. It supported the development of a better end-product with the highest levels of operational and environmental performance. The eventual contract, signed in 2021, represented the culmination of seven years’ work, helped move the industry forward and will leave a lasting legacy for the UK’s future transport system.

Outcomes

Many thousands of businesses were engaged before procurement, during procurement and on an ongoing basis to open up access and opportunity to the wider supply chain. Figure 3 shows the regional engagement map which highlights the success of the engagement of SMEs across the UK and, most importantly, locally along the line of the HS2 route, where over half of HS2’s supply chain is based (2024).

HS2’s tier 1 contractors were re-engaged in 2023 to obtain their feedback on HS2 Ltd’s procurement approach, now it has been played out in delivery, to learn further lessons. Feedback suggested the original strategy and Early Contractor Involvement (ECI) approach to the procurement of civil engineering works was broadly correct given market conditions at the time, with the geographic packaging retaining support. The use and administration of the NEC3 contract was positively received because it drove flexibility, early supply chain involvement and sustainable risk profiles.

Some possible missed opportunities were highlighted by contractors, including the opportunity for HS2 Ltd to progress design to a more mature level prior to contracting, as well as a more strategic, coordinated programme-wide approach for common materials and supply categories, including more centrally controlled logistics management which could have been beneficial. It is worth noting that while some of these concepts were tested in the market engagement phase, the procurement strategies developed were in line with the overwhelming consensus of the supply chain and perhaps reflected a lack of both client and supply chain maturity and capability, at the time with respect to more innovative approaches (perhaps due to the relative inexperience of new-build major rail infrastructure in the UK). Challenges around the alignment between design, procurement and construction programmes were noted in the early phase of ECI, which created inefficiencies.

In 2024, HS2 represents a workforce of over 31,000, including over 1,800 apprentices and 4,500 formally unemployed people who are back into work on the project. Over 3,000 suppliers across the supply chain are delivering the railway across 350 sites, with this number set to grow further as the project continues to drive economic and social benefits across a predominantly UK supply chain.

By 2023, businesses in every UK region shared £11.5 billion of HS2 contract awards in the subcontract supply chain, from Devon to Dundee. Data showed that SMEs, which accounted for 70% of the supply chain, secured £4.5bn of work at tier 2 level (likely to be far higher across the supply chain as a whole), benefitting from HS2 Ltd’s engagement and transparency practices. In 2022/23, HS2 civil engineering contractors doubled spend with SMEs, rising as a proportion of overall spend in the supply chain, to £942m.

The benefits of an early and well engaged supply chain, with a clear understanding of a project’s strategic goals around skills, education, sustainability, diversity and economic growth, including how these are translated into procurement and contracts, is a direct prerequisite to ensuring strong performance. It is also essential to ensuring that suppliers invest for the future, leaving behind a legacy of a more capable supply chain which is fit to deliver future UK infrastructure needs.

Learnings and Recommendations

HS2 Ltd had already adopted legacy learning on the early market engagement approaches adopted by the London 2012 Olympics and Crossrail (Elizabeth Line) programmes. HS2 Ltd recognised that being many times the size of these programmes combined, it had a mammoth task as a new client to attract appetite to supply its ambitious requirements in both scope and scale. To this end, HS2 Ltd identified its stakeholders early and engaged with them methodically, transparently and honestly. Trust with the market was built and in turn honest and insightful feedback received to help it develop its thinking. This process was iterative – as HS2 Ltd matured its client procurement strategies and technical information following feedback, this was played back to the market for comment and further development, to assist with market forming and capacity building (it took time for joint ventures to form and establish). It was important to extend this beyond the ‘tier 1’ contractor market to engage with the end-to-end value chain, by category.

This feedback informed the highest-level strategies at a programme and package level. And wherever this feedback was taken into consideration, zero failed procurements resulted – in fact contract opportunities were able to continue to attract suppliers with the best talent and expertise. Only once when the feedback from a market sounding exercise was discounted, did a procurement launch fail through a lack of market appetite, and once the strategy was adjusted to respond to the feedback, success was achieved. That is not to say a client should blindly follow the advice of the market – it must always be a two-way process which settles on a strategy that meets the needs of the client and its sponsors/funders with the correct risk allocation and value for money, but also the needs and nature of the specific market in the most optimal way, in order to set the supply chain up for success. This is a complex process and requires sufficient self-reflection and market intelligence – as strategies develop it is important to review with internal stakeholders how effectively the final procurement and delivery model aligns with the preferences, constraints and ideas articulated during market engagement. If the strategy diverges significantly from the market feedback, this should always be re-tested to ensure it is deliverable and will attract sufficient competition. Adequate flexibility should be built into the procurement and commercial model to respond to changing market conditions.

The key learnings can be summarised as follows:

- Understand your market. Engage with them early and be honest and transparent with what you know AND also what you do not yet know. Keep suppliers informed throughout the process as information matures.

- Map and engage all stakeholders appropriately in accordance with their input and impact on your project. Ensure internal functional leads and subject matter experts are involved in the process as contributors to the procurement strategy, while external stakeholders (e.g. central government) are kept informed of the evolving strategies through regular dialogue. External bodies, trade associations and suppliers themselves again should have tailored engagement plans, relevant to the specific work package being procured.

- Develop internal client capability in the form of a Supply Chain Management team which sits alongside Procurement & Commercial, to act as an ‘impartial arbiter’ and voice of the supply chain to the client, and client to the supply chain.

- Ensure a clear, coherent and consistent communications strategy which hangs from the overall project requirements, strategic goals and business case benefits. Link to suppliers’ corporate roadmaps where possible to energise and inspire the supply chain to support your ambitions.

- Manage expectations and set out timelines that you can deliver to. Do not over promise and under deliver as this will erode goodwill and more importantly market appetite. Be prepared to evolve the plan in line with the changing needs of the project. In the early days of HS2 there was a frequent optimism bias that strategies and requirements could be developed earlier than was realistic – SCM had to manage the expectations of the market.

- To attract the most capable, innovative supply chain, develop your own client thinking to sufficient maturity before you engage the market, to build credibility and confidence in your approaches and capability. There was sometimes a rush from stakeholders who wanted to engage the market before a credible opportunity had been defined and developed. Often the answer lies within your organisation, it is not for the supply chain to write your specifications for you – they can comment and provide feedback but need a sounding board to do so.

- Always be sure to complete the feedback loop with your supply chains – ensure the outcomes of a market engagement are presented back to suppliers and that revisions to the procurement strategy are continually communicated for comment, so that the market can feel fully engaged right through to procurement start. Once the formal process commences, ensure regular dialogue and updates are maintained through the relevant procurement portal.

- Ensure the outputs of market engagement are data-driven and appropriately reflect the inevitable nuances and influencing factors which influence suppliers’ positions. Ensure the outputs are structured in a way to support decision making, governance and assurance.

- Work collaboratively with the established networks. HS2 Ltd did not create any of its engagement networks, it instead tapped into those well-established trade associations, business networks, Chambers of Commerce, Growth Hubs, national enterprise agencies, etc. and in doing so built collaborative working relationships that have served the project well into delivery and through a series of unprecedented market shocks (the UK’s exit from the EU, a global pandemic and war in strategically important parts of the world).

- Finally, monitor and model the supply chain that comes towards your project to ensure you understand the impact of appetite on capacity, business capability, financial strength, structures, and external influences on these organisations’ ability to continue to deliver.

Conclusion

This learning legacy sets out the key findings from the early market engagement approach at HS2 Ltd from 2013-2020, and the subsequent results of this approach through contract delivery up to 2024. Project procurement and supply chain professionals should maximise early market participation through a structured and agile process, whilst maintaining probity and equal treatment, well in advance of procurement, to ensure the project is deliverable and that market competition can be maximised to ensure value for money.

Acknowledgements

Gardiner & Theobald LLP

References

[1] National Infrastructure Commission. Cost Drivers of Major Infrastructure Projects in the UK; 2024 [cited 2024 Sept 26]. Available from: https://nic.org.uk/studies-reports/cost-effective-delivery/

[2] Construction Leadership Council. The Farmer Review of the UK Construction Labour Model. 2016 [cited 2024 Sept 26]. Available from: https://www.constructionleadershipcouncil.co.uk/wp-content/uploads/2016/10/Farmer-Review.pdf

[3] High Speed Two (HS2) Limited. HS2 Supply Chain Conference 2013 [Internet]. GOV.UK; 2013 [cited 2024 Sep 26]. Available from: https://www.gov.uk/government/publications/hs2-supply-chain-conference-2013

[4] High Speed Two (HS2) Limited. HS2 Supply Chain Conference 2014 [Internet]. GOV.UK; 2014 [cited 2024 Sep 26]. Available from: https://www.gov.uk/government/publications/hs2-supply-chain-conference-2014

[5] High Speed Two (HS2) Limited. HS2 Supply Chain web page [Internet]. Available from: https://www.hs2.org.uk/supply-chain/