HS2 Supplier and Market Risk Monitoring

High Speed Two (HS2) is a project of immense economic scale. In 2016, HS2 Ltd, as the client organisation and delivery body for HS2 faced the challenge of onboarding construction partners and beginning the process of mobilising a supply chain on an unprecedented scale. Without sufficient oversight, the project could be negatively impacted by its own demands on the supply chain and suffer risks from its exposure to external macroeconomic events and industry fragility.

This initiative focused on establishing the processes, systems, and mitigating activities to provide foresight into potential risks that could undermine the supply chain’s ability to deliver the project. This included managing risks of supplier insolvency, over-utilisation and cost fluctuations in key materials, plant and labour due to volatile markets. By 2020, mature working practices ensured high visibility and proactive intervention, minimising the impacts of unexpected supply chain disruptions. In 2023 alone, over 3390 suppliers were being monitored with 75 supplier financial and capacity risks raised across £3.2bn of contracts, the vast majority avoided.

Key learnings from this initiative include the importance of strong supply chain visibility beyond directly contracted suppliers to map and monitor financial, delivery, and capacity risks. Efficient, integrated data management across contractors and internal departments is crucial for real-time insights. Additionally, sector-level knowledge sharing and transparency is vital for addressing broader infrastructure challenges in the UK.

This paper may be of particular interest to supply chain managers, procurement professionals and project leaders involved in large-scale infrastructure projects.

Background and industry context

HS2 is the largest infrastructure project the UK has undertaken for decades. Between London and the West Midlands, the construction of the railway comprises 64 miles of tunnel, 500 bridges, 70 cuttings and 50 viaducts, alongside four new stations and one depot. Although HS2 is an enormous programme of works requiring the mobilisation of huge amounts of resources, HS2 Ltd as a client body generally procured very few, very high value construction related contracts. These included:

- Three joint venture enabling works contractors (delivering demolition, ecology, archaeology and utilities works).

- Four multi-billion joint venture civil engineering contractors (delivering the construction of the route including all earthworks, viaducts, bridges and tunnels).

- Four separate contractors to build each station.

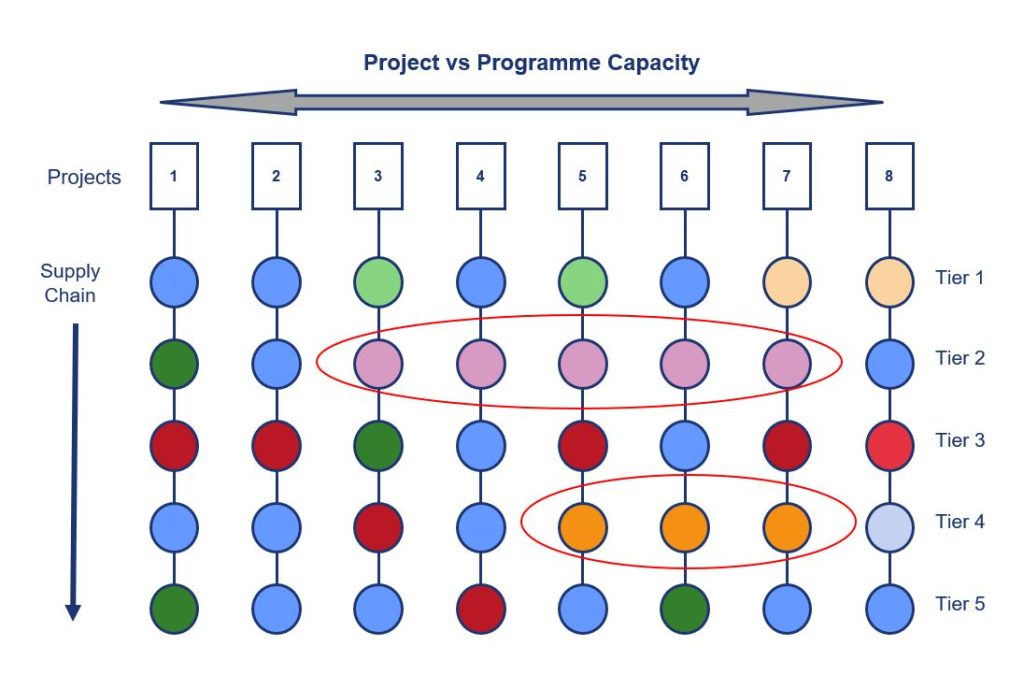

Construction is a project-based industry with typically deep, complex and fluid supply chains which have to be procured and mobilised for each specific project. So-called ‘tier 1’ contractors oversee the management and delivery of the works via a long and fragmented supply chain. To achieve this, these tier 1 contractors, in turn, procure their subcontractors (tier 2s) who in turn procure their tier 3 suppliers and so on down through the tiers of the supply chain. Tier 1 contractors are highly reliant on subcontractors to deliver projects, rather than maintaining their own permanent workforce and asset base in the context of an uncertain pipeline of future work. This entrenches a highly fragmented and often inefficient overall supply chain, which is particularly acute in the UK relative to other European countries. As referenced in a National Infrastructure Commission report [1], tier 1 contractors typically employ 50-70 subcontractors on an infrastructure project (much higher on HS2), while almost 90% of the roughly 23,000 civil engineering companies in the UK employ fewer than eight people.

Suppliers at all tiers require a mixture of plant, labour and materials to operate, which draws upon further third-party resources. In major UK construction, it is typically the lower tier supply chain (tier 2+) which delivers the bulk of work on site, with tier 1 contractors overseeing engineering, design, procurement, programme coordination, logistics, construction management and integration activities. Therefore, having visibility and understanding of the deeper supply chain is key to managing overall programme, financial, capacity and delivery risk from a client perspective. Adopting an appropriate form of contract with suitable works information is important to ensure deeper supply chain visibility and risk apportionment.

When taken in the context of wider UK and global demand placed on the sector’s supply chains, which is often volatile and unpredictable, there was therefore a risk that the huge demand of HS2 placed onto specific markets and sub-sectors would result in supply markets becoming overheated and highly vulnerable to external events.

All suppliers are themselves ‘economic operators’ that rely on the profitable turnover of the value of their contracts to maintain the financial health of their business. As the flow of goods and services are dynamic, it stands to reason that the financial standings of these organisations are also dynamic. Construction as a sector tends to overshoot national economic cycles, so recessions are felt more deeply by a sector which is often undercapitalised, with fragile balance sheets typically more reliant on borrowing to operate. This is principally driven by a low productivity and low profitability industry, despite high risks and insolvencies. [2] Over a build programme which is in excess of ten years, this creates financial stability risks, affects how risk can be apportioned and leads to high exposure to external events and moving markets.

With this in mind and being at the top of the supply chain, the authors’ opinion is that ’client’ organisations like HS2 Ltd are best placed to take a strategic view of the totality of the supply chain. It is essential that clients understand aggregated exposure, areas of overheating, the flow of capital through the supply chain and, with the use of third-party financial monitoring tools, a holistic view of suppliers’ financial health and the risk this poses to continuity of delivery.

Figure 1 above shows how a construction programme is typically divided into different supply chain ‘silos’ which flow from individual ‘tier 1’ contracts based on category (e.g. enabling works, civil engineering, buildings, systems etc). There is little interaction between these silos except where there are ‘common’ subcontractors. A subcontractor working on a single infrastructure project may have five or more different ‘customers’, creating complexity.

HS2 Ltd initially sought to employ similar supply chain management approaches as developed on Crossrail (now the Elizabeth Line). This knowledge transfer was achieved through personnel transfer (both authors have combined experience of London 2012, Crossrail Ltd and Transport for London capital projects). The approach developed was based on employing a programme-wide strategic overview of market and supply management, treating the project as a portfolio with a focus on gathering data on the subcontract supply chain, monitoring its financial health and the macro and micro economic influences that can impact this.

Macro factors typically include changes to the economy (expansion/ recession, changes to investment and taxation etc), the political environment, global events or issues like climate change. They are beyond the control of either the client or its supply chain but can severely impact its ability to deliver. Micro factors pertain to individual businesses within a supply chain, such as their capacity, access to materials and labour, cost/prices, production efficiency, etc., and are within the scope of supply chain management but difficult to control from a client perspective.

Therefore, the HS2 Supply Chain Management (SCM) team was established in 2013 to lead holistic monitoring of the supply chain, as it was mobilised, and provide a unique programme-wide perspective to understand these external market impacts and how to respond. The team has evolved its approach over time and developed a set of integrated dashboards and data systems that are shared with contractors and internal commercial colleagues on a regular and live basis, noting commercial confidentiality, to help them understand the impact of external economic, environmental and social events on the health and capacity of the supply chain, availability and price of commodities and knock-on impacts.

Approach

Micro Environment

Tier 1 contractors typically only have direct visibility of their tier 2s subcontractors and limited indirect visibility of the tier 3s. Recognising that in order to gain visibility of these critical elements of the multiple supply chains, HS2 SCM made submission of a subcontractor procurement schedule a mandatory requirement within the NEC3 Works Information. This ensured that tier 1 contractors provided the necessary procurement and subcontract data on a monthly basis. In turn, this enabled the team to map and monitor suppliers through procurement, during which risk can be avoided, through to contract delivery, during which risk can only ever be mitigated once bought. There is an important link to preliminary market engagement in developing an appropriate contracting model in collaboration with the end-to-end market, as this will influence the tiered nature of the supply chain, the risk profile and a client’s ability to manage this during delivery.

The data requested to be provided was not anything that contractors should not have as part of their procurement and commercial management and due diligence approach. It included the following:

- Contract/package type (using pre-determined categories, for consistency).

- Contract/package description.

- Awarded/tender list supplier name (full entity name).

- Supplier company registration number (or Dun & Bradstreet DUNS number for overseas suppliers, where possible).

- Forecast contract/package value and annual actual and forecast annual spend.

- Contract status (e.g. tender stage, awarded, unsuccessful etc).

Using this data, HS2 SCM could then extract further details using third party financial monitoring providers to ascertain the following data points for each supplier:

- Ultimate Global Parent company (if one exists).

- Registered address.

- Number of employees.

- Most recent financial accounts (including turnover, profit and loss and balance sheet statements).

- Financial health indicators (refreshed every 24 hours with alerts according to parameters set by the HS2 SCM team).

- Various financial ratios indicating liquidity, debt levels, etc.

To ensure suitable focus, ‘critical’ contracts were identified and defined by either the top 80% of contracts by value (pareto analysis), contracts on the ‘critical path’ of the programme, or highly specialised or long lead supply items with limited substitutes.

To begin with, this data was manually imported into a central datasheet, but since 2020 the team developed an integrated supply chain database using Microsoft Access, with an API function to import third party data automatically. Varying trackers were then developed to highlight movements in this data and filter/sort according to different risk indicators.

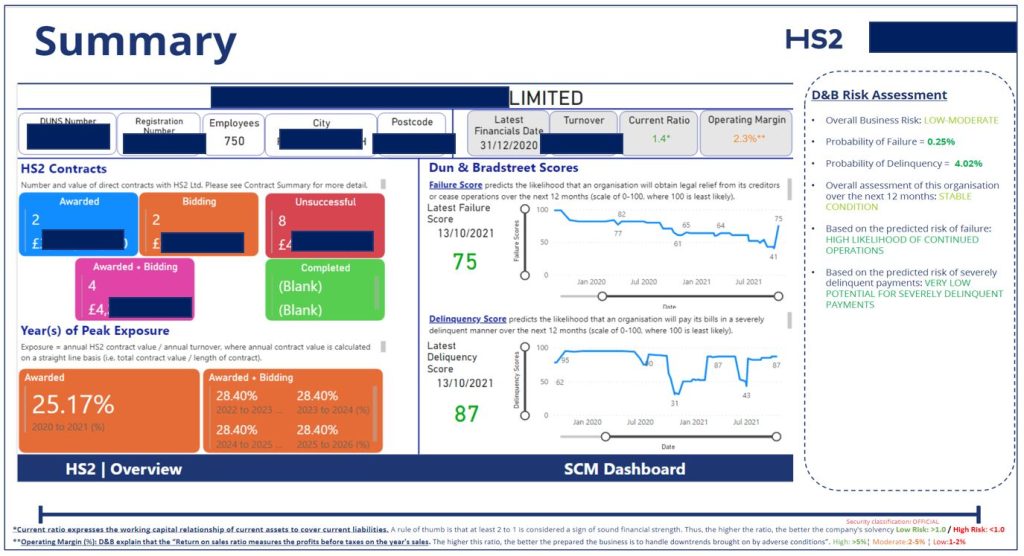

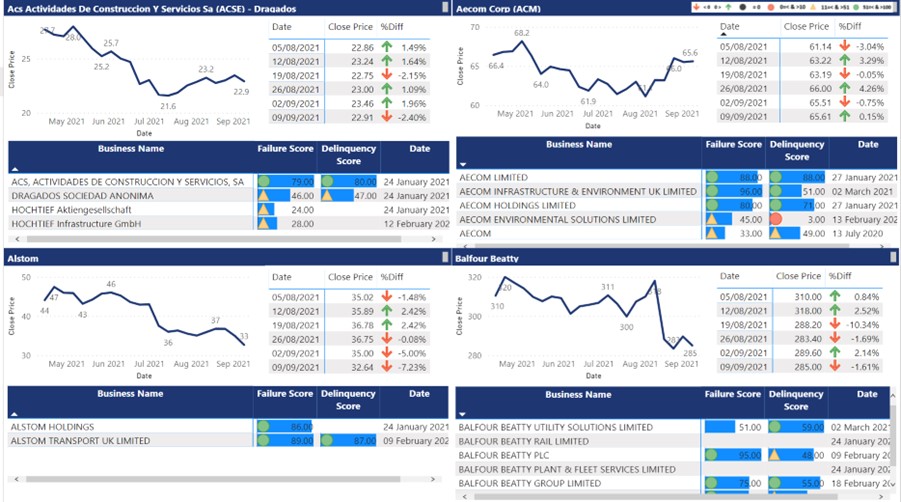

This database was then linked to Power BI outputs that created ‘live’ supplier profiles (see Figure 2), highlighting contracted exposure (forecast aggregated value of all awarded contracts per annum as a percentage of their latest annual turnover), plus potential peak exposure (including the value of bidding contracts, if a supplier were to be successful in winning them). These supplier profiles also captured details around parent companies and family tree structures, displayed financial health indicators and news items relating to the organisation in question.

By monitoring this data on a daily basis, the HS2 SCM team were able to flag various risks associated with suppliers across the HS2 critical supply chain and pursue appropriate mitigation strategies. It was essential that only HS2 Ltd held this data as it was commercially confidential to each tier 1 contractor and they could not possibly know the aggregated exposure of any one supplier appearing at multiple points of a supply chain or across different tier 1 or project supply chains. The types of risks the HS2 SCM team were able to identify and in turn flag to the potentially impacted party included the following:

- Supplier over-utilisation (highlighting individual contract or aggregated exposure when it exceeded 50% in any one year – in some cases on HS2 this was well in excess of 100%, not even accounting for committed work on other projects).

- Poor cash flow that may impact supplier financial health.

- Poor financial strength/health rating.

- The impact of potential geo-political events or shocks (e.g. Covid, Ukraine war etc).

The team continued to develop these tools and the reporting of key risks. Given the size of the supply chain (over 3,000 suppliers), in any given month over 100 potential risks would be displayed. In order to differentiate the level of risk, the team developed an enhanced risk monitoring process which combined quantitative indicators with qualitative indicators using appropriate weightings (totalling 50% for quantitative indicators and 50% for qualitative indicators). Qualitative indicators reflected a subjective assessment of the criticality of the contract, the nature of the market, ease of being able to substitute a supplier, etc. This intelligence was often developed in collaboration with the relevant contractor, for subcontract suppliers, in order to hone in on the most pertinent risks which required mitigation. Such risks and mitigations were tracked centrally by the SCM team (which fed into monthly reporting) and discussed at weekly contractor meetings.

Macro Environment

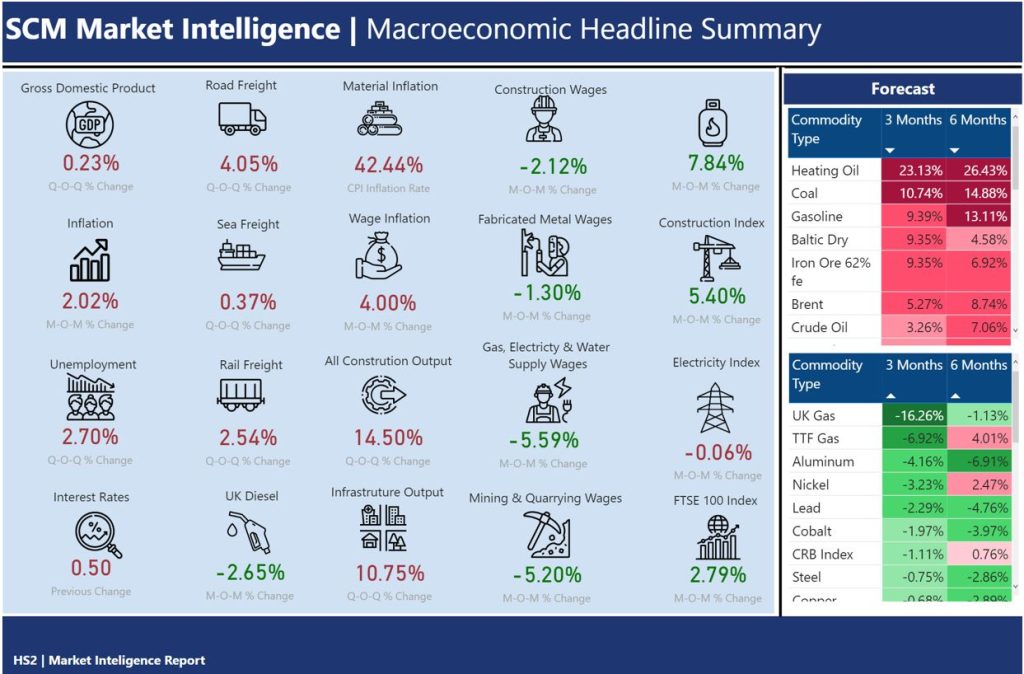

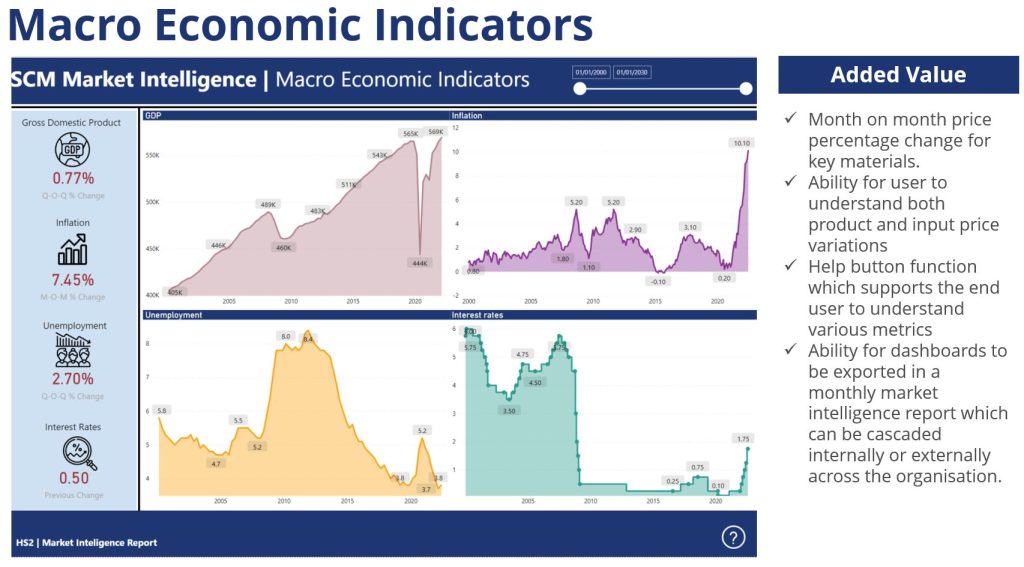

Moving beyond what was achieved at London 2012, Crossrail or Transport for London, to help understand the impact of global events on the supply chain, activities were implemented to assist in monitoring and informing supply chain decisions relating to relevant categories of spend.

The key activities that were designed, implemented and shared with HS2 supply chain partners included:

- Monitoring the short selling of stock of publicly listed critical suppliers.

- Monitoring the share price fluctuations of critical suppliers (see Figure 6).

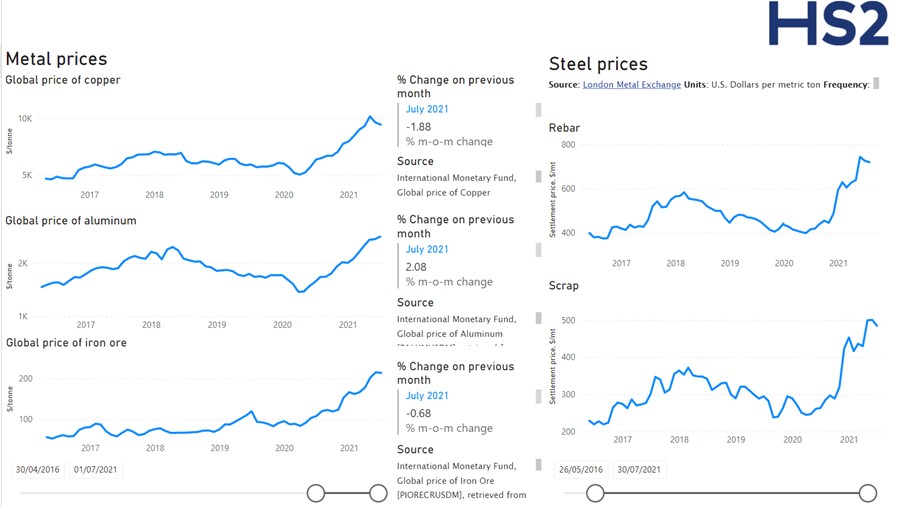

- Publishing and maintaining a Power BI dashboard of critical commodity prices to inform the purchasing decisions of tier 1 contractors (see Figures 3-5).

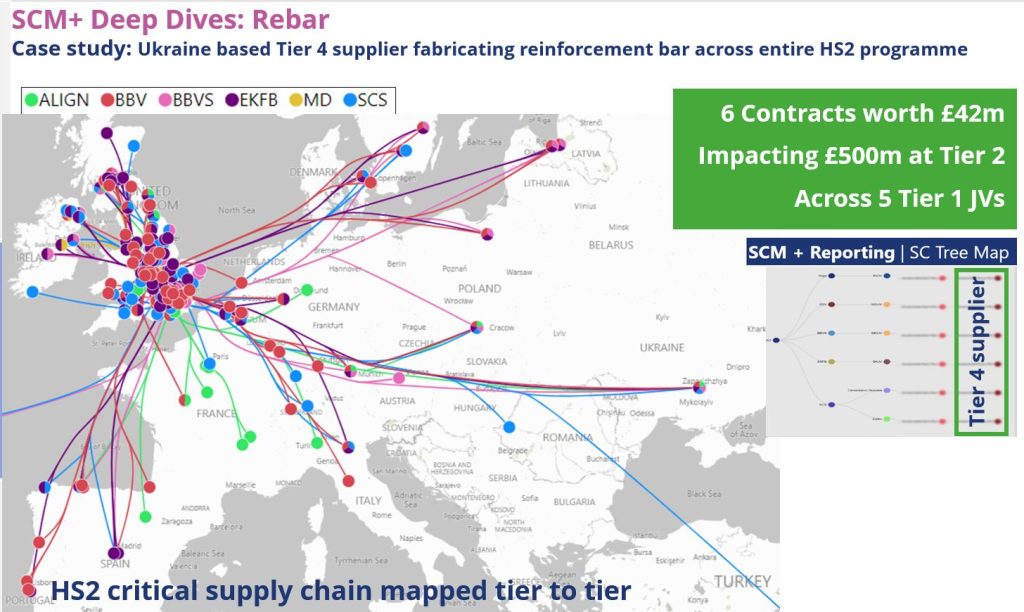

- Supply chain mapping of key supply chain categories to identify overlap of supply, pinch points and bottlenecks, as well as geographic spread, to understand any regional supply impacts arising from global events.

For example, the Ukraine war in 2022 created enormous impacts to the UK construction supply chain, due to disruption to the flow of goods and materials across Europe (Ukraine being a key steel and raw material producer). Coupled with increasing industry demand post-pandemic, this created significant availability constraints of key materials at a critical time for the HS2 programme. The subsequent spike in gas, fuel and electricity prices heavily impacted the price of goods and materials arising from energy-intensive industries, such as steel, cement and concrete. Possessing early intelligence of market movements through interactive dashboards which display real-time third-party data enabled contractors to flex their procurement strategies to avoid over-committing during a heightened market (e.g. through use of ‘spot buying’ to cover short-term demand, or use of hedging or other instruments to spread risk of further price rises). It is important that contractors are held to account for using the information provided by a client SCM or supply chain intelligence function, aligning with commercial positions adopted across the programme.

The following charts provide extracts from the HS2 SCM commodity dashboards, which included data on 38 different commodities and 32 macro-economic indicators.

Insolvency case study – Roadbridge UK

Roadbridge UK was a sub-contractor for two HS2 Joint Venture (JV) contractors, contributing services such as earthworks as part of the main construction works. Roadbridge UK was flagged early as an at-risk supplier on HS2 SCM’s risk dashboards due to its poor financial indicators, including failure risk scores from Dun & Bradstreet and health scores from Company Watch. This prompted HS2 SCM to raise the risk with the JVs in June 2021.

- On March 3, 2022, SCM received reports indicating that Roadbridge UK, along with its parent company Roadbridge Holdings in Ireland, was on the brink of insolvency. In response, the SCM contacted the two JVs working with Roadbridge to provide regular updates and request contingency plans.

- Although Roadbridge UK initially asserted that a buyer had been found and a transaction would be completed, this buy-out did not materialise.

- Consequently, SCM worked with the affected JVs to develop contingency plans, which included use of previous sub-contractors and direct materials orders to avoid delays. The JVs and SCM also coordinated with Grant Thornton regarding Roadbridge’s insolvency and asset recovery, on payments and liabilities.

- A degree of extra complexity arose as Roadbridge was in joint venture with another firm, Tarmac, on one of HS2’s larger subcontracts. Assurances were sought to ensure the contracts would be fulfilled, with a plan to hire Roadbridge staff, negotiate new sub-contracts, and ensure minimal disruption to ongoing projects.

- On March 11, 2022, it was confirmed that Roadbridge had entered receivership.

The HS2 SCM team ensured regular communication with the affected JVs, including any changes to mitigations or actions being undertaken and continued to monitor the situation until the all the affected work was completed successfully.

Outcomes

During 2023 alone the HS2 SCM team identified 75 financial and capacity risks across 3390 suppliers critical to the ongoing delivery of the HS2 infrastructure works. The combined value of the contracts being delivered was £3.2bn. Without the strategic intervention many of these risks would have gone unnoticed and could have negatively impacted the supply chain’s ability to maintain the delivery of their contracts. Through collaboration with contractors, early mitigations such as parent company guarantees, vesting arrangements, bonds, stockholding and other instruments were implemented to mitigate any impacts of suppliers ceasing to trade or failing to deliver.

The macro-economic monitoring allowed HS2 Ltd to map category supply chains to identify convergences of supply and this enabled the HS2 SCM team to highlight dependencies. For example, at the start of the Russian invasion of Ukraine, it was identified that five separate contracts for steel were being sourced from Ukraine deep in the supply chain (see Figure 7), exposing up to £500m worth of key subcontracts under all four main works contractors. This visibility and proactive risk management enabled production to be redirected to mills less impacted by this event.

The supplier and market risk monitoring deployed by HS2 Ltd has been in place to help the project and its suppliers to manage the impacts of both macro and micro economic impacts. Increases in UK interest rates seen during 2021-23, the downturn in sector demand, project pipeline uncertainty (not least the impact of HS2 Phase 2 being cancelled) and the sectors’ well documented poor profitability has seen the highest levels of insolvencies in the sector since the 2008/9 financial crisis as shown in Figure 5[1].

![Figure 8 – Construction insolvency increases since the pandemic.[1]](http://learninglegacy.hs2.org.uk/wp-content/uploads/2025/04/1022-Figure-8.jpg)

The approach developed and deployed by the HS2 SCM team has helped the project navigate these emerging risks and minimise the negative impact of these influences.

Learnings and Recommendations

This approach evolved through collaboration with the supply chain and HS2 Ltd has adopted new ways of data gathering, analysis and presentation in line with the evolution and development of supporting technologies.

This experience has reinforced the belief that programme-wide understanding and visibility of the supply chain is a fundamental prerequisite to appropriately manage risk and identify opportunities to improve performance and avoid issues. You simply cannot manage risk on major capital projects if you do not know who your suppliers are beyond tier 1. The approach employed has generally worked well for managing risk at the tier 2 subcontract level. However, the nature of construction supply chains extend far beyond this, so clients should consider methods which enable them to obtain systematic visibility of their end-to-end supply chains.

As always, good intelligence is underpinned by good data, and given the fluid nature of construction supply chains, ensuring a live, accurate ‘single source of truth’ for contract data remains challenging, especially when you are dependent on third party data provided by contractors and subcontractors. Maintaining good relationships, embedding and cascading appropriate contract terms, and demonstrating the benefit of this data to your supply chain (by allowing them to use your tools and shared intelligence) will all assist in ensuring these tools can add maximum value.

To fully realise the value of this shared intelligence, steps should be taken to ensure that contractors and internal commercial and delivery teams understand and are held accountable for taking appropriate action in response to the insight. It is important that a client is aligned on its role in managing the supply chain, its appetite for risk, and its willingness to make active, targeted interventions when market conditions require.

Data alone only presents a partial story, so it is also imperative for clients to get out into their supply chain, meet with suppliers at different tiers, visit their sites, and listen to their insight and issues – this sort of market intelligence is vital to augmenting quantitative data with the qualitative insight which can be invaluable in understanding the operation of supply chains, the interdependencies, the impact of external factors and crucially what clients can do to facilitate project success.

In addition, clients should also engage their peers to obtain valuable intelligence on supplier performance, risk, mitigations and opportunities for collaboration and data sharing. For example, HS2 SCM regularly met with counterparts within the Department for Transport, Network Rail, National Highways and others to share supply chain intelligence on a confidential basis.

Recommendations for infrastructure clients in future include the following:

- Clients should recognise that tier 1 contractors typically can only see their own subcontractors (tier 2s) and therefore clients have the opportunity to take a strategic interest in the value-add elements of the project-wide, end-to-end supply chain to manage risk and realise opportunities. Consider building/procuring a centralised digital platform which suppliers in every tier are required input their data directly into and draw insight in return.

- Client-led SCM is key to strategic oversight and is eminently achievable if established early and integrated into the contract environment well – it can be non-intrusive, collaborative and lean in its implementation.

- Where possible, clients should embrace and develop leading edge indicators that can forewarn and forearm the supply chain ecosystem to impending influences that impact their ability to deliver.

- Data feeds should be as close to real-time as possible, recognising the dynamic nature of suppliers, markets and economies. This maximises confidence in the tools developed.

- It is essential to build collaborative relationships with the supply chain at multiple tiers to ensure that, as risks are identified, they can be collectively owned and collaboratively managed.

- Regular, ongoing touchpoints and clear, transparent communication with key supply chain partners is essential to building the right collaborative relationships and facilitating the exchange of qualitative information and insight.

- Supplier contingency and mitigation plans at the subcontract level should be developed in collaboration with tier 1 contractors when a risk is identified so that support is gained for the approach advocated.

- A future improvement/evolution for this model would be to ensure that SCM as a function moves its location within an organisation to align with the focus of its activities, i.e. part of the procurement function during the procurement phase and then moving into commercial and delivery functions thereafter.

The major opportunity for this model of Supplier and Market Risk Management arises when clients from across the industry are aligned in this approach. While HS2 Ltd has excellent visibility of its supply chain to tier 2 (with some critical tier 3 and 4 visibility obtained through direct engagement), this is not echoed or mirrored by all infrastructure clients. However, a similar approach, if adopted, would allow a strategic oversight of programmes across many sectors where the supply chains remain very consistent. This would better position UK infrastructure to foresee supply chain risk, guard against external shocks and work collaboratively across different clients, advisors, designers, contractors and subcontractors to mitigate these risks with the parties best placed to do so.

Finally, while the focus of this paper has been risk, it is worth highlighting that a risk identified early enough becomes an opportunity and this model has been successful in turning certain supply risks into strategic opportunities. For example, in 2022 HS2 Ltd identified early capacity constraints in the market for lime, a key building material, whereby HS2 demand exceeded UK production capacity. By working collaboratively with all contractors and the lime production industry, the programme was able to increase capacity through new kilns and in doing so save £100/tonne of additional cost (noting that HS2 demand ran into many hundreds of thousands of tonnes) and create new jobs in the UK.

Conclusion

This learning legacy sets out the key findings from the establishment of the approach to supplier and market risk monitoring at HS2 Ltd from 2013-2024. Project procurement and supply chain professionals should maximise holistic oversight of their supply chain, seek deeper supply chain visibility, enhanced data flows and collaboration across and down the supply chain, linking with other infrastructure clients to share intelligence where possible. This ensures macro and micro supply risks can be suitably managed and mitigated to maintain project delivery and value for money.

Acknowledgements

Gardiner & Theobald LLP

References

[1] National Infrastructure Commission. Cost Drivers of Major Infrastructure Projects in the UK; 2024 [cited 2024 Oct 9]. Available from: https://nic.org.uk/studies-reports/cost-effective-delivery/

[2] McKinsey & Company. The Next Normal in Construction; 2020 [cited 2024 Oct 9]. Available from: https://www.mckinsey.com/capabilities/operations/our-insights/the-next-normal-in-construction-how-disruption-is-reshaping-the-worlds-largest-ecosystem

[3] BBC News. Insolvencies at highest level since 2009: Quarterly company insolvencies in England and Wales [Internet]. 2023 [cited 2024 Oct 9]. Available from: https://www.bbc.co.uk/news/business-67261798